The Only Guide to Banking

Wiki Article

Bank Certificate Things To Know Before You Get This

Table of Contents7 Simple Techniques For Bank StatementBanking for DummiesTop Guidelines Of Bank Statement4 Easy Facts About Bank Definition ShownTop Guidelines Of Banking

When a financial institution is perceivedrightly or wronglyto have troubles, clients, being afraid that they could shed their deposits, may withdraw their funds so quickly that the little section of liquid properties a financial institution holds ends up being promptly exhausted. During such a "work on deposits" a bank might need to market other longer-term as well as much less fluid possessions, frequently muddle-headed, to fulfill the withdrawal demands.

Regulatory authorities have wide powers to interfere in troubled financial institutions to minimize disruptions. Banks are currently required to hold even more and also higher-quality equityfor instance, in the kind of preserved revenues and also paid-in capitalto barrier losses than they were prior to the monetary dilemma.

How Bank can Save You Time, Stress, and Money.

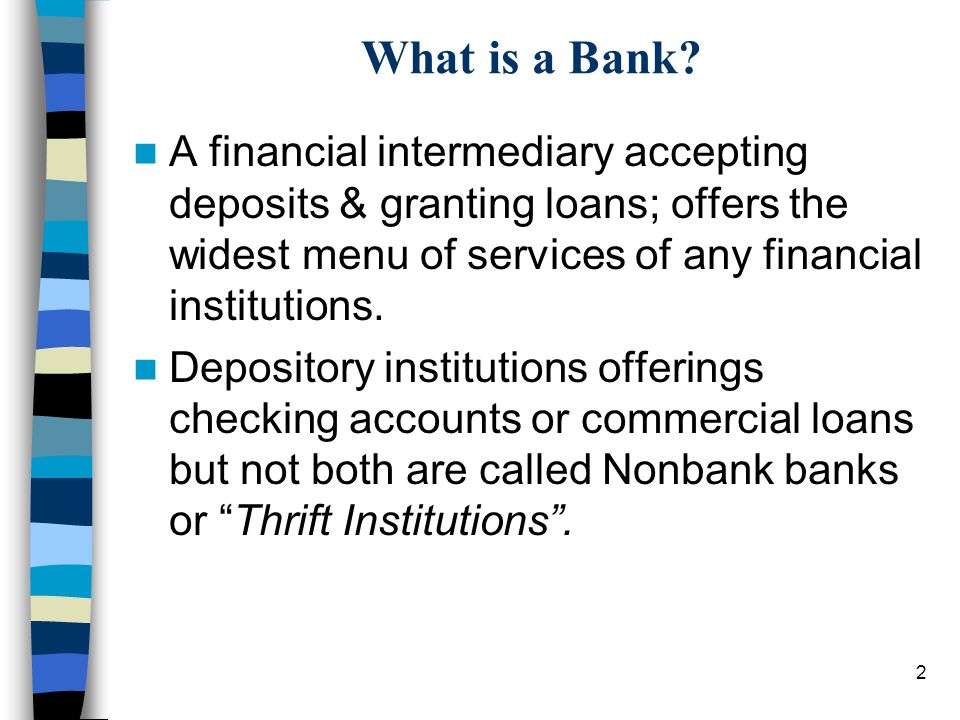

A bank is a monetary establishment authorized to supply service options for consumers that want to save, borrow or build up even more cash. Banks commonly accept deposits from, as well as deal lendings to, their clients. Can aid you obtain funds without a bank checking account.While banks may provide similar financial solutions as credit scores unions, banks are for-profit businesses that route many of their monetary returns to their shareholders. That means that they are much less likely to offer you the ideal feasible terms on a lending or a savings account.

Those borrowers then pay the finance back to the bank, with rate of interest, over a fixed time (bank code). As the debtors pay off their car loans, the financial institution pays a fraction of the paid interest to its account owners for allowing it to make use of the deposited cash for provided loans. To better your personal and also company interests, financial institutions offer a huge range of financial solutions, each with its own positives and also negatives relying on what your money inspirations are and exactly how they could progress.

3 Easy Facts About Bank Statement Shown

are cost savings products that likewise include inspecting account functions, like debit card deals. are containers held in a safe and secure center, like a safe-deposit see it here box, where a vital owner can position and also remove valuable things like jewelry or essential files. Banks are not one-size-fits-all procedures. Various sorts of consumers will certainly discover that some banks are better financial companions for their objectives and needs than others.The Federal Reserve manages other banks based in the U.S., although it is not the only federal government company that does so. Neighborhood banks have less possessions because they are unconnected to a significant national financial institution, but they offer economic services across a smaller sized geographic news footprint, like a region or region.

On-line banks do not have physical locations however have a tendency to provide far better rates of interest on fundings or accounts than banks with physical areas. Deals with these online-only establishments normally occur over a site or mobile application as well as thus are best for a person who does not call for in-person support and also fits with doing a lot of their banking electronically.

Bank Account - The Facts

Unless you plan to stash your cash under your cushion, you will at some point require to connect with an economic establishment that can secure your money or problem you a financing. While a bank may not be the establishment you at some point select for your monetary needs, understanding how they operate as well as the services bankruptcy they can give can aid you choose what to look for when making your selection.Bigger financial institutions will likely have a bunch of brick-and-mortar branches and Atm machines in practical locations, as well as countless electronic banking offerings. What's the distinction in between a bank and also a lending institution? Due to the fact that banks are for-profit institutions, they often tend to use less eye-catching terms for their clients than a credit score union could supply to optimize returns for their financiers.

a long increased mass, esp of planet; pile; ridgea slope, since a hillthe sloping side of any kind of hollow in the ground, esp when bordering a riverthe left bank of a river gets on a viewer's left looking downstream an elevated section, climbing to near the surface area, of the bed of a sea, lake, or river (in combination) sandbank; mudbank the area around the mouth of the shaft of a mine the face of a body of orethe lateral disposition of an airplane concerning its longitudinal axis during a turn, Likewise called: financial, camber, cant, superelevation a bend on a roadway or on a train, sports, cycling, or other track having the outdoors built greater than the within in order to decrease the impacts of centrifugal force on lorries, runners, and so on, rounding it at rate and in some situations to assist in drainagethe padding of a billiard table. bank account.

Little Known Questions About Bank Statement.

You'll need to offer a bank declaration when you make an application for a finance, data taxes, or declare divorce. Loading Something is filling. A bank declaration is a paper that summarizes your account activity over a particular time period. A "declaration period" is normally one month, however it could be one quarter in many cases.

Report this wiki page